During a recent webinar recapping the 2023 State of Commercial Banking report, we asked financial institution professionals to name their top three priorities for 2023, and more than 150 of them listed digital transformation, deposit growth, and relationship expansion and cross sell. These answers were consistent across the board, from large national financial institutions to small community banks and credit unions.

It’s not surprising. Financial institutions are experiencing single-digit loan growth, rather than the double-digit loan growth experienced over recent years, according to American Banker. As a result, banks and credit unions are recognizing the need to shift from a “grow at all costs” mentality to prioritizing the management and protection of the relationships they already have. It’s no longer enough to secure the credit relationship and hope for more.

Financial institutions that want to remain profitable through these market pivots understand they must diversify their portfolios and capture revenue across more treasury services—but they face challenges.

The first is a lack of collaboration and communication across business units (for example, credit and treasury). It’s not uncommon for the treasury officer to be unaware of new deals until after they’re finalized with relationship managers, for example. This lack of collaboration is exacerbated by disparate approval processes, tools, and incentives within the financial institution.

Second, treasury pricing is labor intensive and lacks context around holistic relationships. An attendee at a recent event told us that understanding the true value of a client required the sales officers to go to four people internally and takes a week to pull together the data. In the end, the team received a spreadsheet that was 75 pages long.

Equally important is the labor-intensity issue. On average, four to five manual re-entries per deal is common, meaning financial institutions may lose money because of simple and avoidable entry errors. One global financial institution told us that, in a single year, it lost about $800K collectively because of avoidable entry errors. Additionally, major gaps between pricing expectations and final profitability are a common pain point, as there’s often little to no accountability for promised services and products.

The third challenge is that treasury services are being sold short and their true revenue potential is underutilized. Within banks and credit unions, there is a lack of guidance around pricing methodology and a minimal understanding of cross-sell potential within customer relationships.

The question is how to address these three challenges and also win the entire commercial banking relationship holistically and maximize revenue opportunities with customers.

The answer is Q2’s Premium Treasury Pricing, which helps financial institutions win the entire banking relationship with their clients. The Premium Treasury Pricing solution—which replaces conventional pro forma tools to deliver a comprehensive approach to commercial relationship pricing and structuring for relationship managers and treasury officers within Q2 PrecisionLender—helps position financial institutions to win the entire commercial banking deal, ultimately driving primacy, profitability, and efficiency.

Let’s take a closer look at the four key components of Q2’s Premium Treasury Pricing Solution.

Prioritize relationship economics. This begins with a historical review of the behavior of the relationship to drive renewal/repricing decisions. Additional features include opportunity pricing based on each relationship’s profitability, configurable profitability assumptions and targets by region, and multiple scenario pricing to compare trade-offs. Pricing decisions are unified across the entire relationship into a single experience.

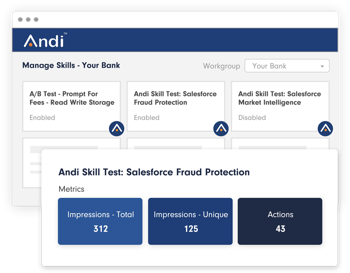

Identify and value cross-sell opportunities. Q2 PrecisionLender’s AI tool, Andi, performs a portfolio analysis to identify opportunities and then identify products that have the biggest impact within each opportunity—all of which helps deepen relationships. Andi also provides contextual coaching for the entire deal team.

Facilitate effective collaboration. The need to integrate systems is something we hear time and again from our clients. It’s difficult to have collaboration when teams are working in six or seven different systems. Our solution (which can integrate with major CRM and LOS systems) fosters better visibility, approvals, workflow, and onboarding—resulting in robust pricing across products. And team members receive tailored Andi coaching to encourage profitability, growth, and cross-sell workflow.

Measure performance and ensure accountability. Any solution is only as good as its reporting, and we offer reporting and coaching to ensure promised business comes to fruition. Rich data is used to analyze relationship management performance, incentivize goals, and share best practices among all members of the deal team.

Winning the Battle of Primacy

With Q2 Premium Treasury Pricing, banks and credit unions can win the battle of primacy right now with existing functionality. Q2 Premium Treasury Pricing is a part of Q2 Catalyst, a suite of best-in-class commercial banking solutions, and supports Q2’s strategic approach to innovation. The solution will empower deal team members with the technology needed to build and expand client relationships. Click here to learn more.