If the last few years have taught us anything, it’s that the key to staying ahead, empowering teams, and executing on pricing strategy comes down to having a platform that is easy to use and can drive action through insights tailored to the unique needs of a financial institution (FI). However, insights are only as good as their delivery mechanism. This is where Q2 PrecisionLender can help; more specifically, Andi.

Andi is the virtual advisor for coaching and actionable insights on the PrecisionLender commercial pricing and profitability management platform and delivers the right message, at the right time, for the right user to ensure FIs are effective at driving profitable growth. FI teams comprised of relationship managers, lending specialists, and other key decision makers that engage with Andi achieve a higher net income on newly originated loans.

Andi and tailored skills management

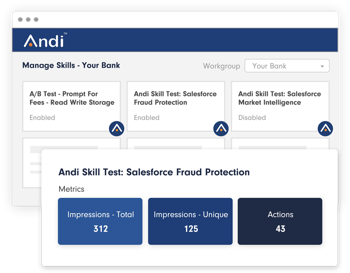

Andi offers tailored information that will make the most significant impact as teams are pricing deals which are called Andi Skills. FI teams can manage their Andi experience through the Andi Skills Manager. Andi Skills include:

• Out of the box common skills (i.e., the default experience)

• Gallery skills that include over 40 skills covering a range from profitability to client service

• Custom skills using Andi Skills Builder and/or from Professional Services

Of these options, custom skills have a much higher engagement rate with users since they’re created to meet the unique needs of each client, but they carry a price tag. With the introduction of Andi Blueprints, the custom skills needed by an FI can be created without a cost.

Andi Blueprints democratizes skill building

Andi Blueprints bring a no-code means to create a custom Andi experience. Blueprints can facilitate better staff training (and retention) while providing another tool to compete effectively in loan pricing.

The availability of Andi Blueprints has produced a lot of excitement among our clients and piqued more interest from prospects in the PrecisionLender platform. Ryan Mino, FVP of Valley Bank, expressed this excitement: “Rather than just go through the motions of pricing an opportunity, Blueprints will guide our RMs to deliver better outcomes for our customers and bank.”

Skills created can meet various needs to ensure timely communication, accurate pricing, and implement strategy when teams need it the most – while they price new deals. Andi Blueprints will:

• Provide all the training, guidance, and guardrails needed through Andi

• Report on opportunity data to keep a pulse on KPIs (Key Performance Indicators)

• Collect additional data for enhanced analytics

How simple is it to put the blueprints to work?

Andi Blueprints use a configuration wizard to effortlessly guide you through each input and selection needed. Once complete, Andi creates the skill code in the background through a click of the ‘Build’ button without any development experience required.

FIs engaged in testing have found it to be a straightforward process. Brooke Hunter, Director of Wholesale Credit Pricing Strategy at Bank of America, conveyed just how easy when she said, “Blueprints takes Andi customization ease to a whole new level, especially for those without a coding skillset. In just a few minutes, we can add new Andi guidance, alerts, and actions with very specific criteria on where and when to display. Our users get the guidance they need more quickly than ever before, and for administrators, the entry interface is intuitive and comprehensive.”

What’s next in 2023?

For the PrecisionLender team – like all the other product and solutions teams at Q2 – going deeper into data-driven insights while providing customized experiences are “table stakes” in 2023. The availability of Andi Blueprints is a great start to the year but expect more impactful tools to come as we extend the value of Andi across Q2.

Learn more about PrecisionLender and Andi or contact us for a conversation.