Better serve customers with relevant data insights

Gain insights from your data to understand account holder journeys, predict their needs, and offer solutions precisely when they’re needed. This is all possible with Q2 SMART™.

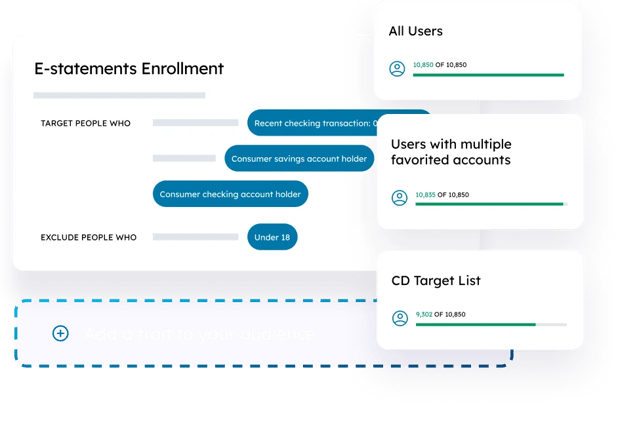

Use data to match the right message to right account holder

Data tells a story, and every digital banking transaction is a useful data point. Q2 SMART—our targeting and messaging platform—aggregates and analyzes these data points, enabling insightful data-driven marketing campaigns.

Patterns in customer journeys identify wants and needs.

Machine-learning algorithms identify and optimize patterns as enough data is collected to verify them as patterns. Based on these patterns, a recommendation engine suggests which products and services to promote to which account holders, as well as which product campaigns might be most impactful for your enterprise.

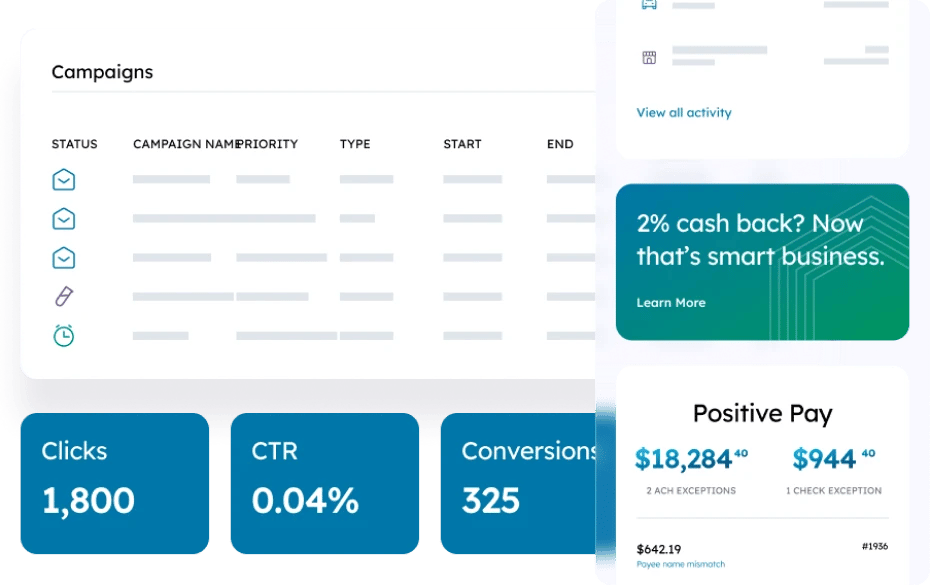

A user-friendly dashboard helps drive your targeted marketing.

With a user-friendly dashboard you can easily uncover opportunities to engage account holders at the right time to deliver relevant solutions and an exceptional customer experience to build stronger relationships.

Revenue-building marketing for digital banking

Deploy multiple targeted multichannel marketing campaigns based on account holders’ specific product and service need.

Message with precision and personalization.

Crafting an effective message is only possible if you know your audience. Segment, export, or promote to granular audience groups in minutes.

A predictive approach to selling

Use relevant demographic, transactional, and sequential action information to predict behaviors, anticipate needs, and personalize engagements with account holders, providing an enhanced experience for them and increased revenue for you.

Proven Success

-

40%

Q2 customers use Q2 SMART for targeted marketing campaigns.

*Q2 internal metrics - 1X Recommended audiences are 3X more likely to adopt a new product or service

Results from some of our customers campaigns

- $1M 1700 loans at $3.6M originated

- $2M $2 million in new balances from 540 existing card transfers

- 300 CDs 332 CDs sold; 1,000+ click-throughs

- 111 111 checking accounts sold; 10,000 click-throughs

Resources

Additional products

-

Data-driven Marketing

Data-Driven for better marketing outcomes.

-

In-App Guides & Analytics

Create valuable in-app guides to improve the account holder experience.